Optimizing Financial Data Governance for Improved Risk Management and Regulatory Reporting in Data Lakes

Abstract

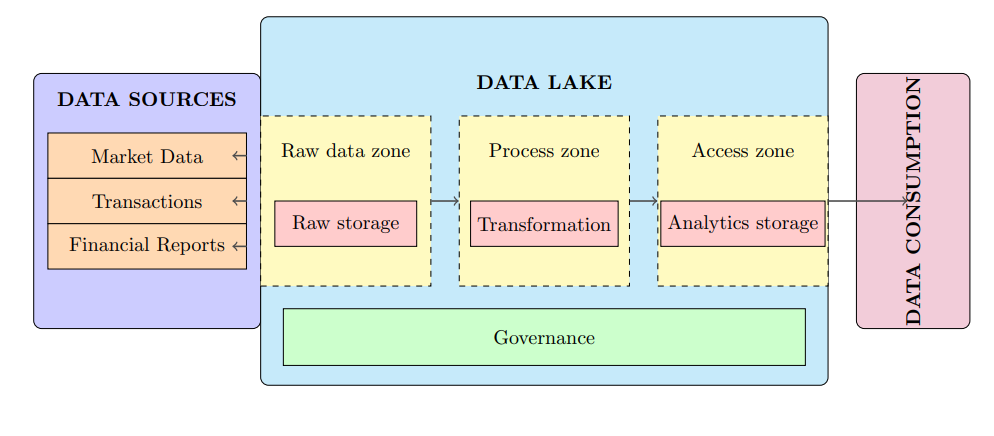

The financial services industry increasingly relies on data lakes to manage vast quantities of diverse data for insights, risk management, and regulatory reporting. However, the flexibility and scale of data lakes also introduce significant challenges in ensuring data integrity, lineage, and consistency—core elements crucial for reliable risk management and compliance. This paper explores the role of data governance in financial institutions, emphasizing its importance in maintaining data accuracy and transparency. It discusses the specific challenges of implementing data governance within the data environments of financial services, where data silos and regulatory demands add layers of difficulty. The paper proposes governance frameworks adapted to the unique needs of financial institutions, highlighting the integration of data governance practices into data lake architectures. Special focus is given to metadata management and lineage tracking as tools to foster trust and compliance. The findings recommends the necessity for financial institutions to adopt robust data governance strategies, ensuring that data lakes enhance rather than hinder their risk management and regulatory reporting capabilities.

Keywords

Big data analytics, Data governance, ETL processes, Hadoop ecosystems, Hybrid data architecture, Machine Learning, Schema conversion